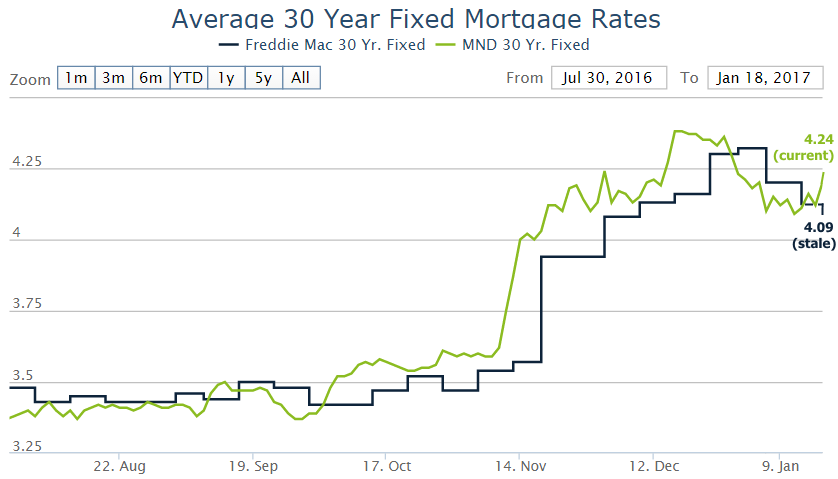

Freddie Mac's weekly mortgage rate survey came out this morning showing the lowest rates in 3 weeks (don't get excited). This happens due to the survey's methodology, which unfortunately relies on Monday/Tuesday rates almost exclusively. With lenders closed for business on Monday and with Tuesday legitimately being in line with the lowest rates of the year, Freddie's headline is perfectly defensible--assuming we're not talking about yesterday or today. If we are, then things are much worse.

After an abrupt increase yesterday, mortgage rates shot higher again today, bringing them even further into the worst territory of the month. In fact, apart from December 14th through 28th, today's rates are the highest in more than 2 years. Whether this is as dramatic as it sounds depends on your perspective. While it's true that rates are at 2017 highs, the range has been fairly narrow so far this year. Specifically, rates have only risen about .125% since Tuesday's 3-week lows. That equates to roughly $21/month on a $300,000 loan.

A more tangible consequence of the rate spike could be seen in the form of higher closing costs for borrowers wishing to lock the same rates quoted yesterday or the day before. On average, you'd need to pay an extra $650-750 (per $100k financed) upfront to lower your rate by .125%. In that sense, if you opted not to lock a $300k loan on Wednesday, the past 2 days cost $1950-$2250. For most scenarios, it will simply make more sense to move up .125% in rate.