The latest Home Purchase Sentiment Index (HPSI) remained at an elevated level Fannie Mae said today, but internal data within the index does not bode well for housing inventories. The Index, derived from answers given to six of the primary questions contained in the company's National Housing Survey (NHS), decreased by 2.4 points to 80.8 in November.

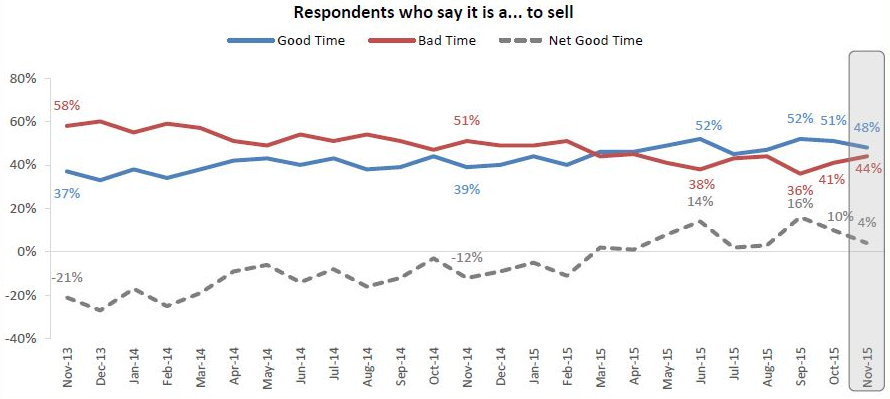

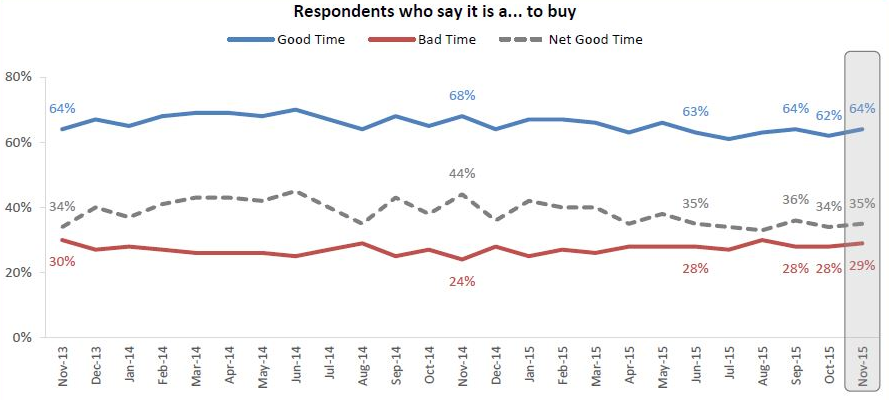

That reading is near the survey high which occurred in June, but responses to a key index component, whether it is a good time to sell a house, fell by six points on net and fewer than half of respondents (48 percent) consider it a good time to sell while 44 percent consider it a bad time. Responses that it is a good time to buy moved up 2 points to 64.

Concern about job loss remains minimal - 84 percent of respondents are unconcerned about the possibility of job loss although that did decline by a point. However respondents reporting a higher household income over the last 12 months has dropped by 6 percentage points since September, to 21 percent, while those reporting lower income rose to 15 percent in November from 13 percent in October. The net level of those responses set this HPSI component back to just below its March 2015 level.

"The latest reading of the remains near the survey's high witnessed in June, exemplifying the theme we laid out at the beginning of the year: the economy drags housing upward," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "While aggregate income growth has gradually picked up with a continually improving labor market, consumers' assessment of their income over the past year has not yet shown sustained improvement, partially weighing on overall sentiment. This year's housing market is poised to be the best since 2007; however, consumers' ability and willingness to purchase a home is likely to remain an issue in many regions going forward until we see consumer confidence in their income growth consistently gain traction."

The net share of respondents who say that home prices will go up remained constant at 38 percent while the net of those who say mortgage interest rates will go down fell 2 percentage points to negative 48%.

The HPSI distills information about consumers' home purchase sentiment from the NHS into a single number intended to reflect consumers' current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making. The NHS polls 1,000 Americans by phone each month to assess their attitudes toward owning and renting a home, home and rental price changes, homeownership distress, the economy, household finances, and overall consumer confidence. Of the more than 100 questions asked in the survey six are used to construct the HPSI; whether they consider it a good or bad time to buy or sell a home, the direction they expect home prices and interest rates to move, their concern about their own job stability and whether their incomes are rising, falling, or staying the same.