Rising prices, especially in major cities like San Francisco, Seattle, and Boston which hit new price highs in 2015 have created renewed concerns about affordability. However CoreLogic research analyst Andrew LePage, writing for the company's Insights blog says that looking at housing from the prospective of mortgage payments over the last quarter century one sees that affordability doesn't look so bad, especially at more local levels.

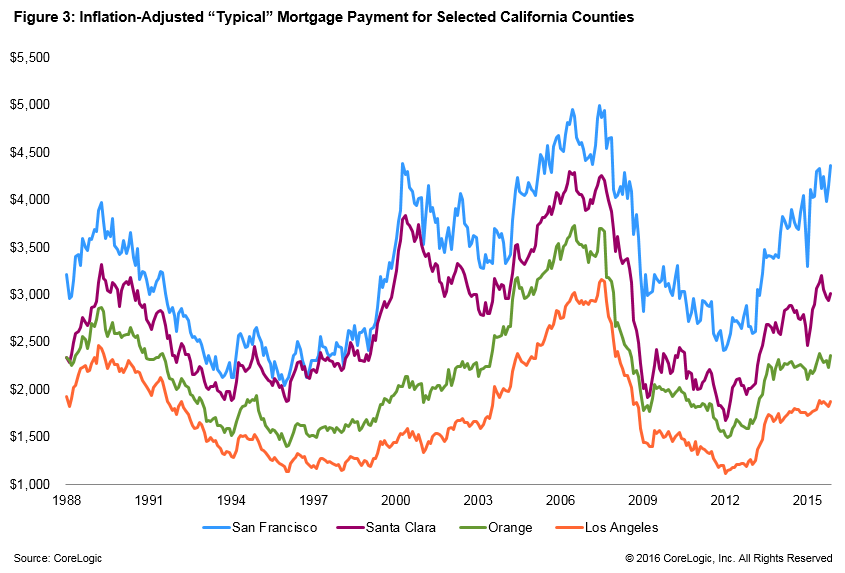

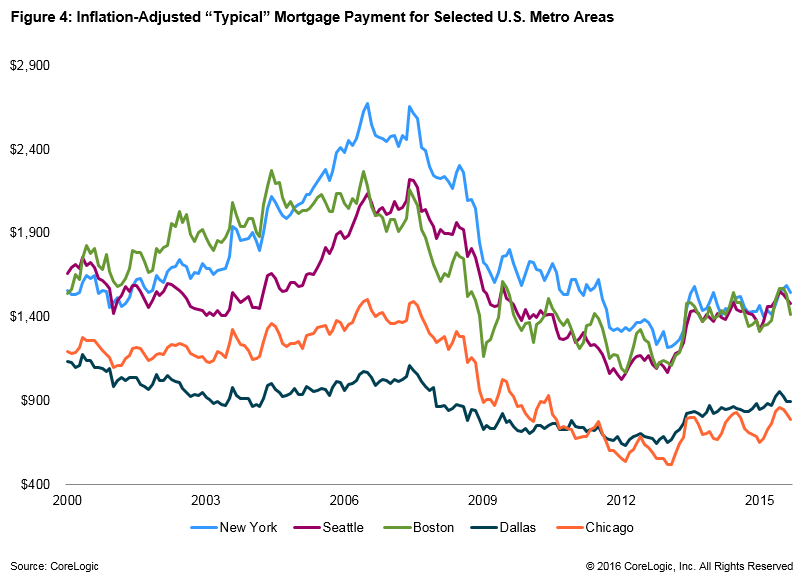

LePage says the monthly mortgage payment is a key measure of affordability since that is the number used to qualify a borrower. He looked at the ups and downs of payments calculated from a local area's median sale price and adjusted for inflation to derive what he calls a typical mortgage payment over time. The calculation assumes a 20 percent downpayment and a 30-year fixed rate mortgage at the prevailing Freddie Mac interest rate.

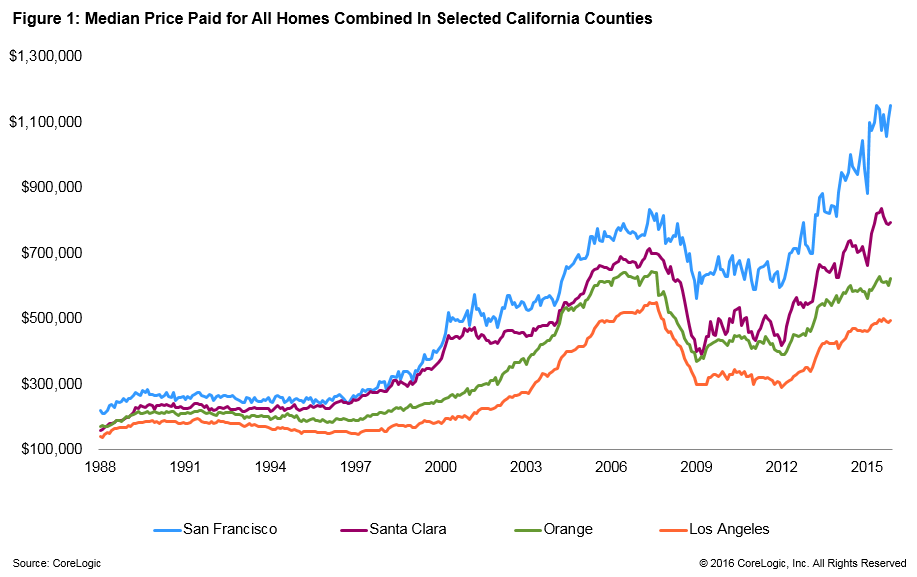

He calculated payments in four California counties, San Francisco, Orange, Santa Clara, and Los Angeles. Median home prices in San Francisco topped previous records, hitting $1.15 million in both May and November, but because of low mortgage rates the typical mortgage payment there in November was $4,360, 13 percent below the inflation adjusted peak of $4,997 in June 2007 when the median price was $825,000 but mortgage rates were around 6.7 percent.

LePage also looked at 11 metro areas and found typical mortgage payments to be 20 to 50 percent below peak levels in prior cycles. In metro Dallas the median sales price hit a new peak of $252,000 but the mortgage payment in September was 24 percent below the peak reached in the spring of 2015. In New York the median home price was still 11 percent off of the area's peak but the typical mortgage payment was 42 percent lower.

LePage says mortgage payments are more likely to be near or at a peak today in smaller housing markets where economic and income growth are strong and the housing supply is constrained. He points to Palo Alto where the typical monthly payment peaked at (gulp) $10,751 last fall as the median home price also peaked at nearly $2.9 million.

He concludes that the typical mortgage payment doesn't tell the whole affordability story either. One needs to take into account other factors such as monthly rent levels and local income growth or lack of the same.