After a steep dive in October, America's attitude toward buying a home is on the rise again. Positive answers to the question of whether it is a good time to buy on Fannie Mae's November National Housing Survey rose 11 percentage points to a net of 32 percent, 9 points higher than in November 2018 and its highest point since March 2018.

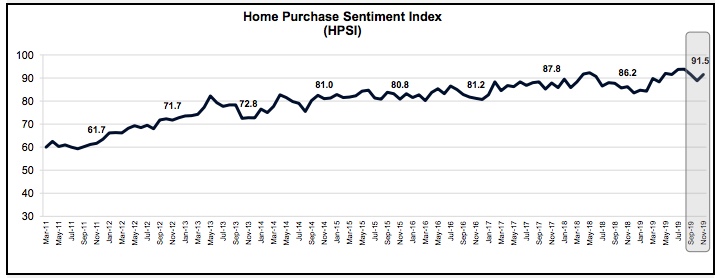

That answer helped drive the Home Purchase Sentiment Index (HPSI) up 2.7 points to 91.5. The index had declined the two previous months but is now up 5.3 points year-over-year and is close to returning to the all time high of 93.8 set in August.

The HPSI is constructed from responses to six questions included in Fannie Mae's monthly National Housing Survey (NHS). Half of the six index components moved higher in November.

Also pushing the overall index higher was a 3-point increase (to 44 percent) in the number of respondents who expect home prices to move higher over the next 12 months. Coupled with a 4-point decline in those who expect lower prices, the net positive responses grew 7 points to 34 percent, 1 point higher than the previous November.

There was also a net gain, albeit a small one, in those respondents reporting significantly higher household income than a year earlier. That net increased 2 points to 18 percent due to fewer respondents reporting lower income while high income responses were flat at 28 percent.

The other three components declined. The percentage of those saying it is a good time to sell a house dipped 1 point to 66 percent as did the net positive responses. The net of 40 percent is 5 points higher than a year earlier.

Fewer respondents expect interest rates to decline over the next year, ticking down from 12 to 11 percent while those expecting them to rise increased 2 points to 39 percent. This lowered the net positive responses to -28 percent, a 3-point reduction.

The final component which measures job concerns remained flat. Eighty-six percent said they were not concerned about losing their job, the same as in October, while 14 percent expressed concern, also unchanged.

"Over

the past year, a growing share of consumers say that they expect mortgage rates

to remain steady," said Doug Duncan, Senior Vice President and Chief Economist.

"While low rates have helped boost housing affordability compared to last year,

the HPSI has increased only moderately in that timeframe. This may be due in

part to the ongoing challenge of tight housing supply, especially in the

starter home market. That lean supply means the recent mortgage rate decline -

holding payment size constant - allows borrowers to increase bid prices for

homes. As a result, home prices are propelled higher, mitigating the benefit of

lower borrowing costs for many borrowers. Additionally, a rising savings rate

suggests that consumers could be growing more financially conservative. Looking

ahead, we continue to expect a steady but modest pace of growth in home

purchase activity."

The NHS, from which the HPSI is constructed, is conducted monthly by telephone

among 1,000 consumers, both homeowners and renters. In addition to the six questions that form

the framework of the index, respondents are asked questions about the economy,

personal finances, attitudes about getting a mortgage, and questions to track

attitudinal shifts. The November 2019

National Housing Survey was conducted between November 1 and November 24, 2019.