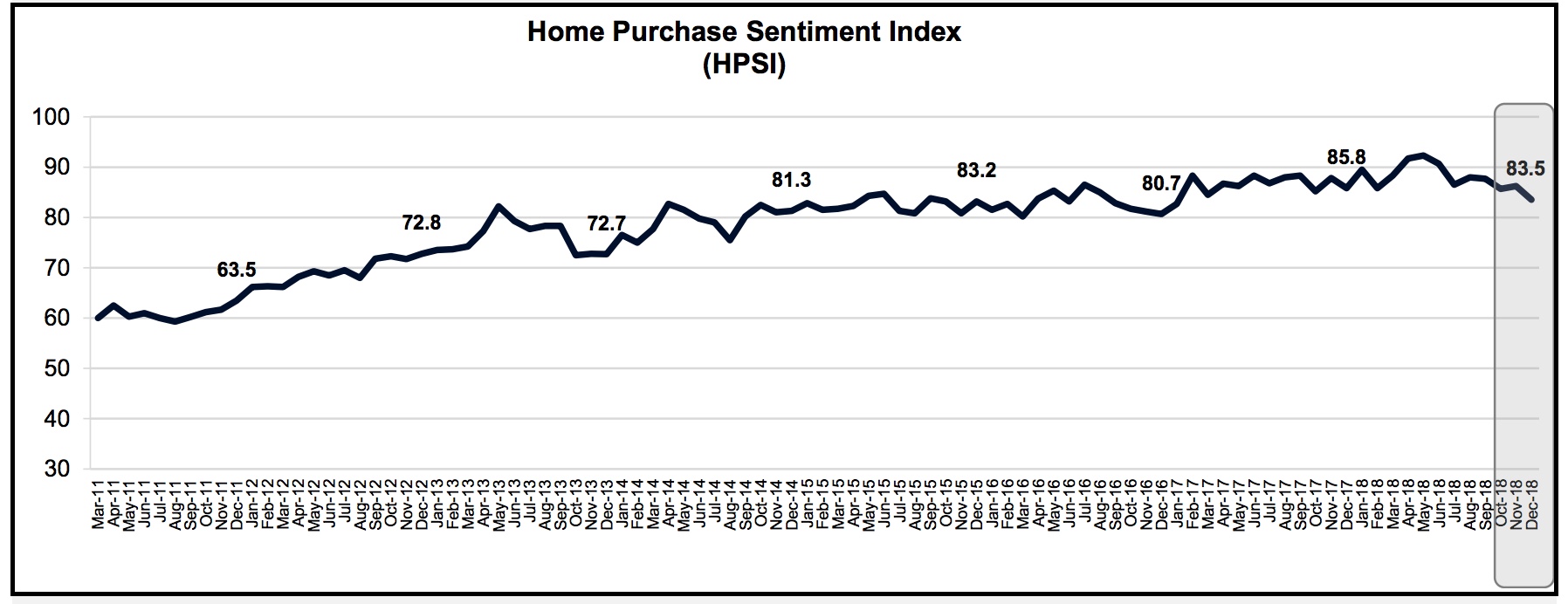

A few more Americans decided it might be a good time to buy a home in November, but boy did they change their minds in December. Fannie Mae said the net positive responses to that question in its December National Housing Survey (NHL) plunged 12 points last month, dragging its Home Purchase Sentiment Index down to 83.5. This is 2.7 points lower than in November and down 2.3 points year-over-year.

The share of survey respondents who thought it was a good time to buy dropped 5 points to 52 percent while there was a 7-point increase in those who thought it was a bad time, to 41 percent. The resulting net of 11 points was the lowest in NHS history and 13 points lower than in December 2017. Net positive responses to whether it was a good time to sell went up 1 point to 36 percent and is 2 points higher than a year earlier.

Another component of the HSPI is the share of respondents who say their income is significantly higher than 12 months earlier. The net of positive responses fell 5 points to a net of 19 percent, erasing November's identical gain. It remains 3 percentage points higher than last year. Meanwhile the share expressing greater job confidence increased 2 percentage points on net to 79 percent, 11 points higher than in December of last year

The net share of those who say home prices will rise fell 2 percentage points to 31%, declining for the third consecutive month. This component is down 13 percentage points from the same time last year. While it is not part of the HPSI calculation, among those who continue to think prices will grow, expectations for the degree of appreciation declined from 2.5 to 2.3 percent. The net of respondents expecting a decline in mortgage rates was unchanged at a negative 56 percent.

"Consumer attitudes regarding whether it's a good time to buy a home worsened significantly in the last month, as well as from a year ago, to a survey low," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "Although home price growth slowed in 2018, the cumulative impact of sustained, robust increases in home prices outpacing income growth likely helped drive the share of consumers citing high home prices as a primary reason for a bad time to buy a home to a survey high. Meanwhile, consumers' views on the direction of the economy, a key support for housing market sentiment of late, has softened somewhat from its October high. Looking ahead, consumers expect the pace of home price growth to slow over the course of 2019, which may temper growing concern over housing affordability."

The Home Purchase Sentiment Index (HPSI) distills information about consumers' home purchase sentiment from Fannie Mae's National Housing Survey® (NHS) into a single number. The HPSI reflects consumers' current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making. The HPSI is constructed from answers to six NHS questions that solicit consumers' evaluations of housing market conditions and address topics that are related to their home purchase decisions. The questions ask consumers whether they think that it is a good or bad time to buy or to sell a house, what direction they expect home prices and mortgage interest rates to move, how concerned they are about losing their jobs, and whether their incomes are higher than they were a year earlier.

The NHS, from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. Respondents are asked more than 100 questions to track attitudinal shifts. The December 2018 National Housing Survey was conducted between December 1st to 21st, but primarily during the initial two weeks of that period.